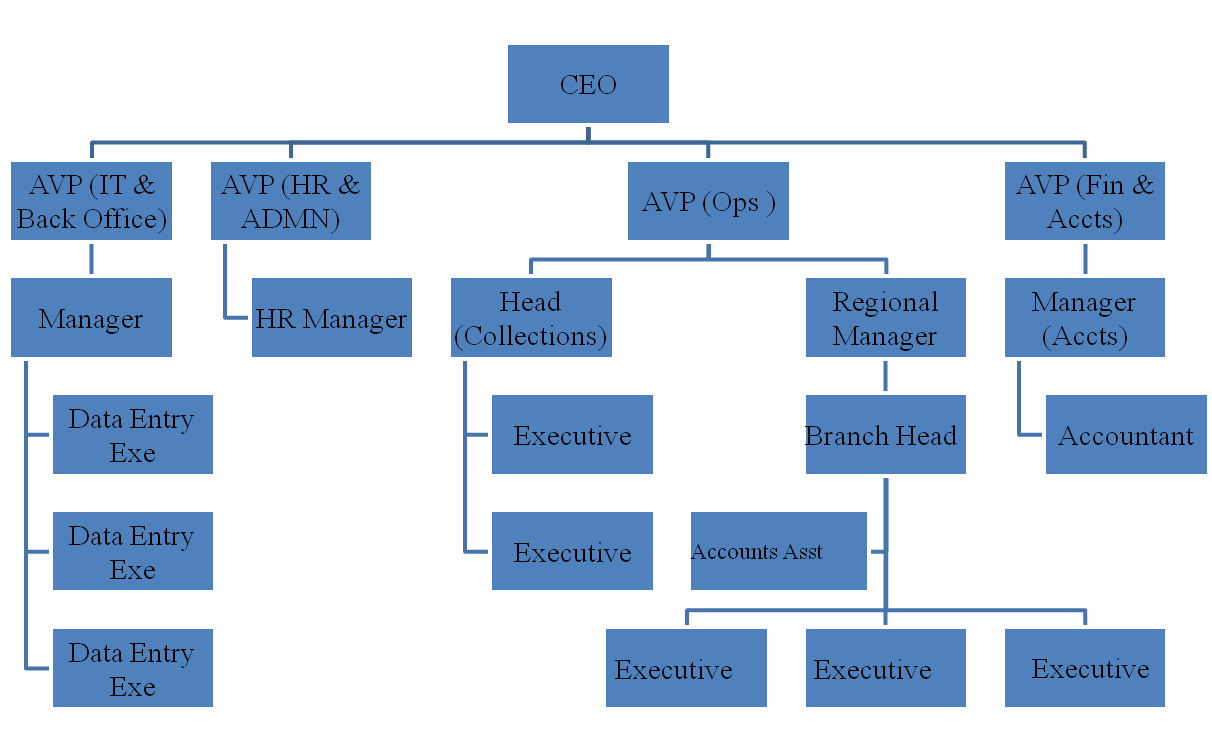

Governance / Organisation Structure

Mimoza is a for-profit Non Banking Finance Company with a focus on Micro Enterprise lending. However, at the outset, it was a microfinance institution owned by different shareholders. Present promoter is having around 23% stake in the company and has initiated steps for full ownership by taking over the company with majority stake. The application has been submitted to Reserve Bank of India for the takeover and the process is expected to be completed within a maximum period of 6 months.

Mimoza will further raise capital from the market, preferably from one or two major investors in the beginning, while the promoter would retain about 15-20% ownership. First round of equity would be leveraged up to 3 to 5 times before going for new capital infusion. Eventually the ownership is expected to be reasonably distributed between private domestic investors, international investors and promoters/management.

Mimoza has 2 nominee board members comprising of microfinance, banking and development professionals. It will have 3-4 member board after RBI approval comprising 1 investor representative, 2 independent experts with relevant background and the promoter. (See appendix 1 for board bios). It is also anticipated that there will be 3 sub-committees with representation from board members and external advisors for overseeing risk management, internal audit and policy compliance, and capital management functions. These committees would be set up gradually as the need arises, but not later than two years from inception.

Organisation Chart